Understanding Direct Tax: An Overview in Depth

It is the process through which a person or a firm has to pay a due amount of money to the government. All fiscal policies have direct taxation as their essential element. It differs from indirect taxes, as it is not levied on goods and services but rather directly on income or wealth. In the following article, an overview of what direct tax is, its types, its implications, and its integration into economic policy will be given. Further, we will discuss the direct taxation system of Ireland in detail.

What is Direct Tax?

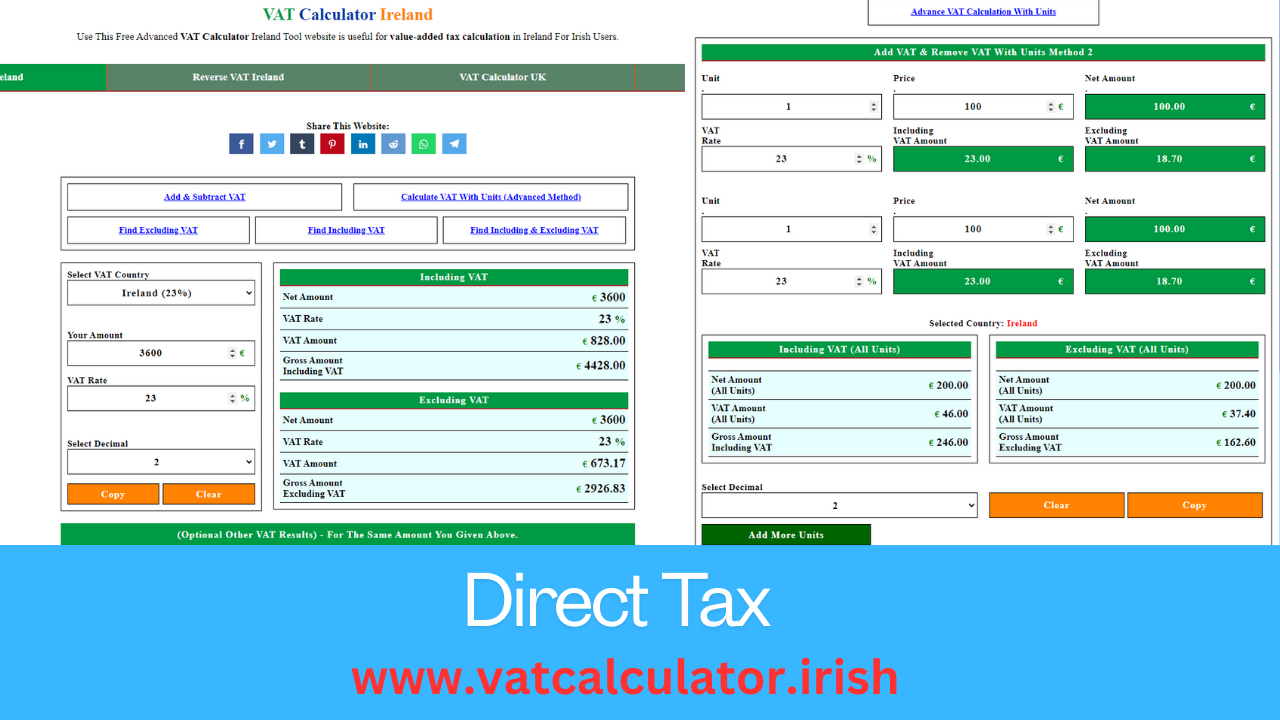

Direct tax is a type of tax that is directly paid into the hands of the government through the taxpayer. The liability amount depends upon the income or wealth that the taxpayer has, not because of consuming any particular good or service. This is opposite to any indirect tax, like sales tax or VAT (Value-added tax), imposed on the transaction and absorbed by the consumers.

Characteristics of Direct Tax

- Levied on Income and Wealth: Direct taxes are all those taxes charged in respect of income, profits, or property.

- Progressive in Nature: Most of the direct taxes are progressive in nature, with the rate of taxation growing along with the income of the earners. More simply, higher-income earners pay a higher proportion of their income as tax than the lower-income earners.

- Paid Directly: The taxpayer pays this type of tax without intermediaries directly to the government, while, in the case of indirect tax, it is paid by the businesses producing or providing such services that also collect the tax.

Types of Direct Tax

Direct taxes may be further subdivided into a number of types, each with its different characteristics and uses.

- Income Tax: Income tax is the single largest source of revenue for most countries of the world. This tax is imposed on individuals and other entities depending upon their various earnings or profits.

- Individual Income Tax: The tax levied on the income of individuals, which includes items like wages, salaries, dividends, and capital gains.

- Corporate Income Tax: An income tax levied on the profits of companies, which have deducted allowable expenses.

- Property Tax: Taxes that could be levied on the value of real estate are usually by the local government and in forms such as land tax, building tax, and any tax on other constructions on the land. At times, property tax pays for vital services like schools and roads.

- Wealth Tax: A wealth tax is levied on the net wealth of an individual, such as real estate, stocks and bonds, and cash. Although applied almost nowhere, it has become a very popular concept with most economists in an attempt to fight disparities in wealth distribution.

- Capital Gains Tax: Any gain realized by the sale of any form of asset has a sure target for capital gains tax, with common ones including stocks, bonds, and real estate. It normally works on the basis of the difference between the purchase and selling price of the asset.

- Inheritance Tax: Inheritance tax represents the tax levied on an individual's estate before its distribution among heirs. The rate of tax largely depends on the relationship of the deceased with the beneficiary, with closer relatives entitled to low or minimal rates.

Merits of Direct Tax

- Equitable and Fair: It is also generally perceived that direct taxes are fairer than indirect taxes. They concern the paying ability of the individual, in that higher income earners pay a more significant share of their income, therefore reducing income inequality.

- Stability of Revenue: Direct taxes provide a certain revenue stream to governments. When the level of income rises, the revenue from taxes will rise as well, therefore allowing the authorities to maintain or even enhance the public services provided.

- Transparency: Direct taxes are usually more transparent than indirect taxes. The taxpayer can clearly see how much he or she pays and the reason behind his or her paying this amount. When taxpayers are aware of the amount they are paying and the rationale behind it, trust in the tax system is developed.

Disadvantages of Direct Tax

- Compliance Burden: Direct taxes can impose a compliance burden on taxpayers-particularly individuals and small businesses. The process of submitting tax returns and keeping records can be quite cumbersome and time-consuming.

- Economic Disincentives: High direct tax rates can be counterproductive to work and investment decisions. When the perception is that too much of their earnings are taken in the form of taxes, individuals may not be as motivated to increase their productivity or invest in growth opportunities.

- Evasion and Avoidance: Direct taxes are more vulnerable to evasion and avoidance practices. Individuals and corporations in various ways attempt to minimize their tax burdens, with considerable loss of revenue to governments.

The Role of Direct Tax in Economic Policy

Direct taxes are one of the most important components comprising a nation's economic policy. Direct tax plays a major role in financing governmental services, income redistribution, and affecting economic behavior.

- Payment toward Public Services: Taxes, to many countries of the world, are considered a mainstream source of revenue that enables governments to finance essential services in education, healthcare, infrastructural development, and social welfare.

- Income Redistribution: Through this, the government is able to impose higher tax rates on rich people and businesses, thereby reallocating wealth in order to narrow the gap between income and make resources available for fulfilling basic needs.

- Economic Regulation: Taxes can be used with the motive of influencing economic behavior in a certain direction. The rate of capital gain tax can be increased by a government in order to discourage speculative investment or impose higher taxes on goods that are luxurious to persuade people to consume in a more sustainable manner.

Direct Tax in Ireland

Ireland has a direct tax system that includes progressive income taxes, capital gains taxes, and corporate taxes unique in nature. The system of income tax operates progressively; this is stated to mean that those earning more pay more in terms of tax rates.

- Taxation of Individuals: The individual income tax in Ireland has a two-tier system where there is a standard rate and a higher rate. The standard rate for 2023 stands at 20% on income to a threshold, while the higher rate stands at 40% above the threshold amount. In addition, the various credit reliefs availed, which are deducted against the overall liability assessed on the individual, create a fair and equitable tax system.

- Corporate Tax: Ireland has one of the lowest levels of corporate tax at 12.5%, especially for multinational companies that avail themselves of a vast business sector. For this reason, it attracts a good proportion of enterprises seeking to establish bases in Europe. This rate is also applicable to the income from trading; hence, Ireland is a country where businesses would like to start their activities in Europe. The government still continues to streamline its policies on tax with a view to striking a balance between attracting foreign investment and harnessing reasonable resources for public finances.

Conclusion

Direct taxation is an indispensable ingredient in any country's taxation scheme, as it plays a dominant role in financing government services and fostering equity, in addition to having economic behavioral functions. The challenges thrown up by direct taxation are many: compliance burdens, disincentives-economic in character the benefits accrued by this type of tax in terms of stability, equitability, and transparency cannot be replicated for a balanced economy.

As earlier argued, Ireland's direct regime is perceived to offer a fine balance in getting reasonable contributions from all citizens towards the National Treasury while allowing her economic growth through attractive income tax rates and a progressive income tax regime. Therefore, Ireland offers a relatively competitive environment both for companies and individuals by balancing the need for public funding with the need to encourage investment and innovation.